Sustainability | Free Full-Text | VAT Efficiency—A Discussion on the VAT System in the European Union | HTML

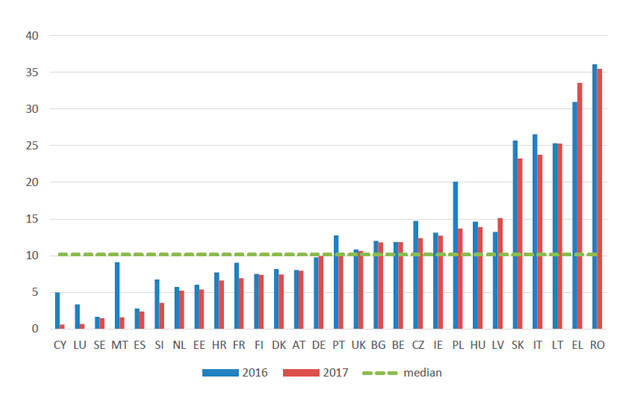

European Commission 🇪🇺 on Twitter: "EU countries lost almost €150 billion in #VAT revenues in 2016, according to our new study. They have been reducing this 'VAT Gap', but a substantial improvement

Before We Close Tax Gaps, We Have to Understand Them - CASE - Center for Social and Economic Research

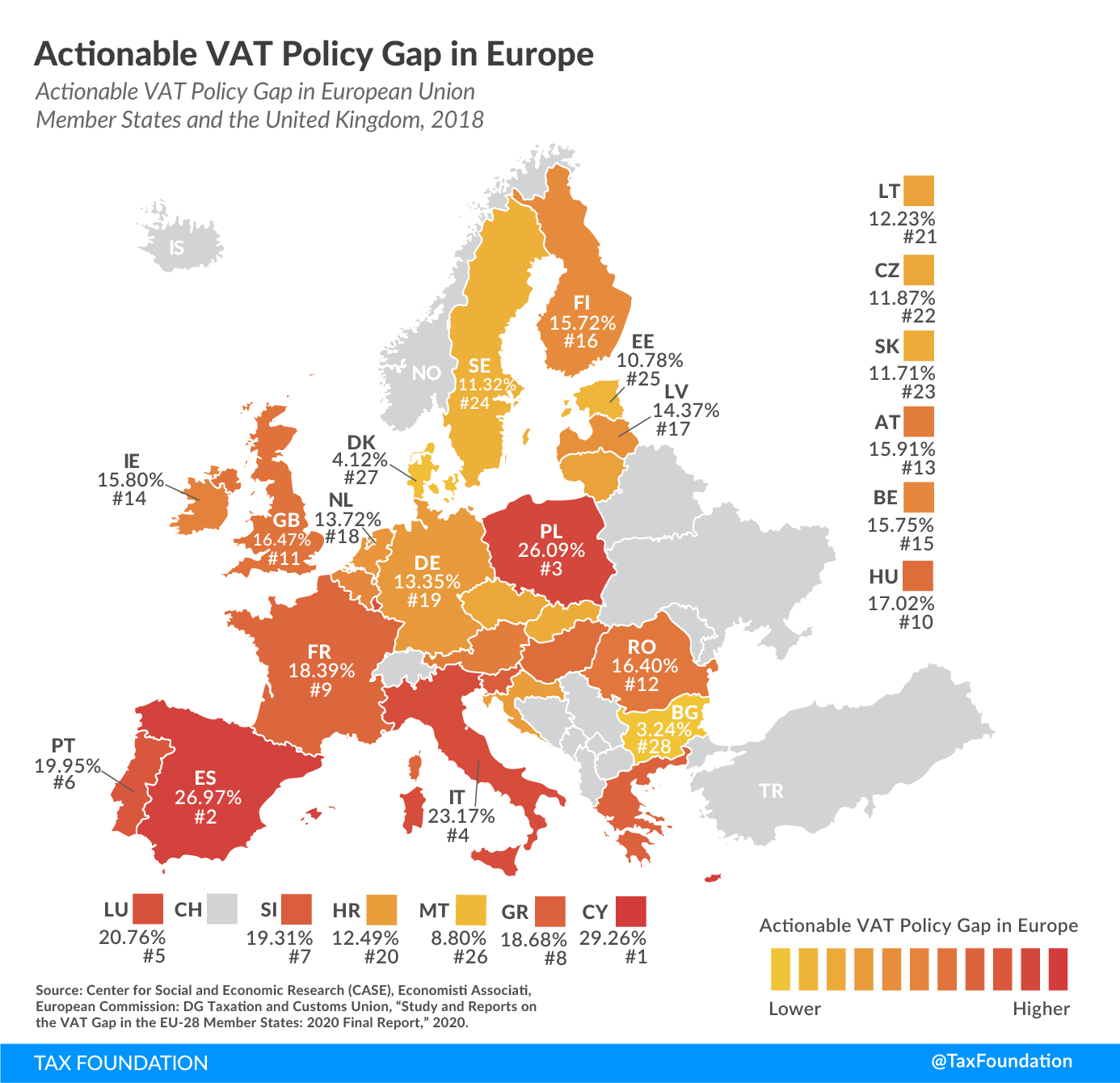

European Commission 🇪🇺 on Twitter: "A new report shows that EU countries lost an estimated €140 billion in VAT revenues in 2018. While it's an improvement in recent years, 2020 forecast expects