Double Harmonic Volatility Indicator + Time Box Indicator (Free) | Timeboxing, Free tools, Investing

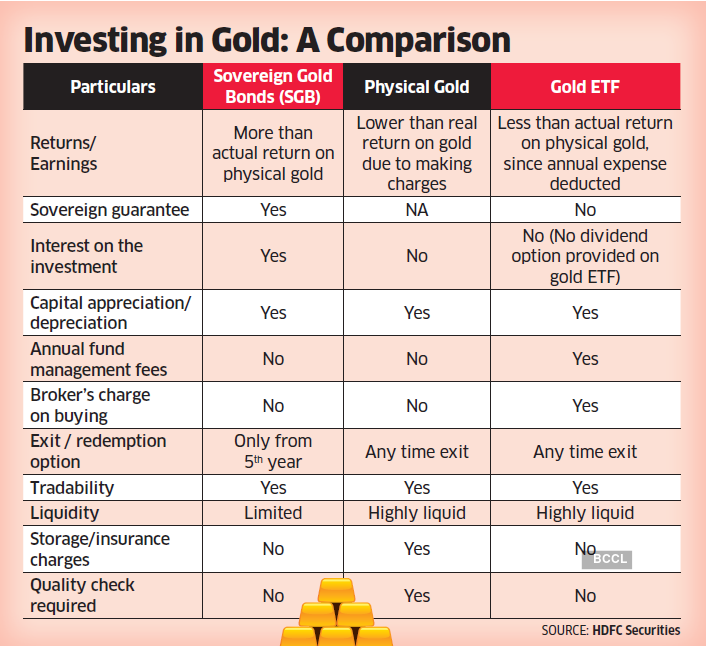

gold bonds: Invest 5-10% of portfolio in sovereign gold bonds to guard against volatility - The Economic Times

A forecast comparison of volatility models: does anything beat a GARCH(1,1)? - Hansen - 2005 - Journal of Applied Econometrics - Wiley Online Library

Robust time-consistent mean–variance portfolio selection problem with multivariate stochastic volatility | Request PDF

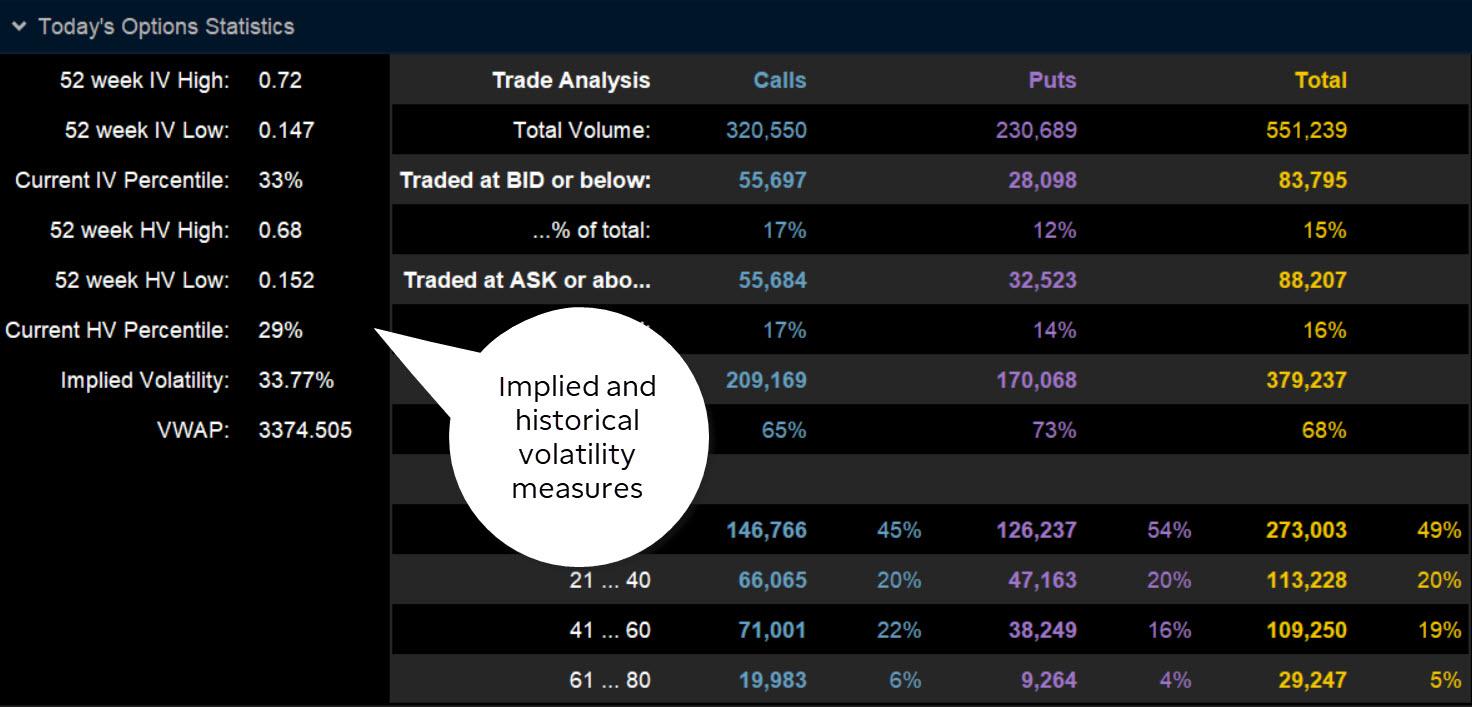

:max_bytes(150000):strip_icc()/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

:max_bytes(150000):strip_icc()/ProfitFromVolatility1-4f68837d0ec244df8eb775a9e65bcf40.png)

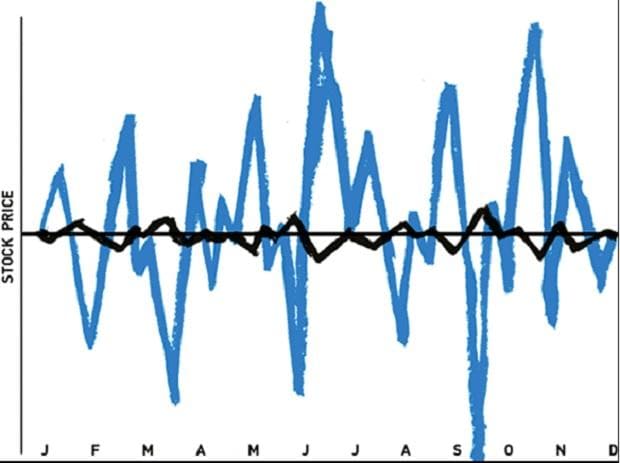

/dotdash_Final_What_Is_the_Best_Measure_of_Stock_Price_Volatility_Nov_2020-01-a8e356925bcb472194445af0b566336b.jpg)